Five years into the 5G era, there is 5G coverage in many places, but the networks have yet to fulfill their initial promises. Many consumers and businesses are disappointed since they anticipated revolutionary changes: a world with ubiquitous ultra-fast connectivity, autonomous connected vehicles, and a digitalized society driven by many Internet-of-things sensors. While such use cases remain on the roadmap of possibilities, the telecom industry’s 5G marketing gave the impression that they would be instantly available in the 5G era. The core of the problem is that no clear distinction was made between 5G networks and 5G services. I will elaborate on these issues and how to avoid a similar disappointment with 6G.

The four stages of development

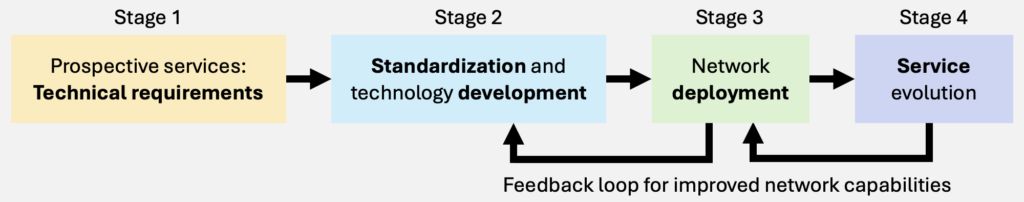

The development and lifespan of a cellular technology generation can be roughly divided into four stages:

The first stage defines the technical performance requirements in categories such as data rates, reliability, latency, and number of connected devices. These were called IMT-2020 in the case of 5G and were first published in 2015. The performance numbers were selected by studying prospective use cases and their potential connectivity needs. For example, a collection of European vendors, operators, verticals, and universities studied 12 test cases within the METIS project.

The second stage consists of developing a standard that is theoretically capable of reaching the IMT-2020 requirements, as well as developing standard-compliant practical implementations, including hardware and software. The first release of the 5G standard was finalized in 2018, and field trials were conducted both before and afterward.

The third stage entails deploying commercial networks. The first 5G-compliant networks were opened for customers in 2019, and the coverage has since increased from a few city centers per country to the majority of the population in many countries. The service offerings have focused on mobile broadband and fixed wireless access—the same services as in 4G, but with faster speed per device, more data per month in subscriptions, and fewer congestion issues.

The 5G network infrastructure also provides the foundation for companies and industries to design, test, and launch radically new connectivity services, particularly building on ultra-reliable low-latency communications (URLLC) and massive machine-type communication (mMTC). These are two 5G capabilities that did not exist in 4G but were added in the hope that they would lead to new services and revenue streams in the 5G era. Since every person already has a smartphone and is reluctant to pay more for their subscription, increased revenue is tightly connected to creating new service categories and connecting new devices. The service evolution is the fourth and final stage in the development, and there is a feedback loop to Stages 2 and 3 since the standard and network also evolve within each generation.

In a nutshell, 5G networks are the infrastructure that enables connectivity, while 5G services are new monetizable use cases of the networks. The current 5G disappointment was created because the public could not distinguish these things but expected to get the previously advertised 5G services when the 5G networks were launched. This happened even if 5G networks have been successful in delivering on the promised technical capabilities, such has higher data rates and capacity.

Prospective versus real services

The prospective use cases identified in Stage 1 of the 5G development were nothing but a brainstorming list created by telecom researchers tasked with predicting what might be required ten years into the future. Unfortunately, the telecom industry began advertising them heavily to the public, giving the impression that these were the real services that 5G would support in Stage 4. Now, when 5G networks have existed for five years without any of these 5G-branded services, it is unsurprising that people and businesses have been disenchanted.

5G networks will hopefully enable some new “5G services” that can bring new revenue streams to the financially stressed mobile network operators. However, designing such services takes time and effort because one must create an end-to-end ecosystem with the required hardware, software, and business models. For example, wireless automation of a factory requires collaboration between the factory owner, manufacturers of factory equipment, vendors for both network infrastructure and devices, and the intended network operators.

The development of new 5G services was initially delayed because most telecom operators deployed non-standalone 5G networks, consisting of 5G base stations anchored to a legacy 4G core network infrastructure. New capabilities such as URLLC and mMTC cannot be used without a 5G core, which created a chicken-and-egg situation: New services could not be created without a 5G core, and the cost of deploying a 5G core could not be motivated since no new services were ready for launch.

Fortunately, the core networks have now begun to be upgraded, so testing of new use cases and services is possible. Since 2024, I have been an advisor for the Advanced Digitalisation program in Sweden, which provides co-funding for companies that collaborate in developing 5G services that fit their businesses. There is much enthusiasm for these activities but also an awareness that there are many missing pieces in the 5G service puzzles to be found.

Lessons learned for 6G

Based on these experiences, I get worried when I see 6G services already being discussed in publications, conferences, and press releases. The 6G development has just entered Stage 2. The IMT-2030 requirements are taking form, and during the next five years, the 6G network technology will be standardized and developed to reach those goals. We can expect 6G network deployments to begin around 2030 and initially provide better performance and efficiency for already existing services. It is not until 2035 that entirely new services might take off and hopefully create new revenue streams for the network operators. These services might require new functionalities provided by 6G, such as edge intelligence, radar sensing, and ubiquitous coverage. It could also be related to augmented reality glasses for consumers or digitalization/automation of businesses or society—we can only speculate at this point.

Right now, the essential thing is to develop a 6G technology that can provide even greater communication, localization, and sensing performance. The future will tell which innovative services can be built on top of the 6G network infrastructure, when they will be available, and how to monetize them. We must remember that revolutionary changes happen slowly, are often only observable retrospectively, and usually differ greatly from the initial visions.

If the telecom industry describes futuristic use cases in its initial 6G marketing, it will likely create a 6G dissatisfaction that resembles the current 5G disappointment. Hence, I urge the telecom industry to work in parallel with developing new 5G services that can be launched in the coming years and 6G network technology that can be rolled out in the next decade but focus the marketing on the 5G services. It is first when 6G networks reach the trial phase that the development of 6G services can truly begin, so there is something concrete to spread to the public.

This is a very insightful blog that highlights the gap between the marketing promises of 5G and the reality of what it has delivered so far. It’s a great reminder that network infrastructure takes time to evolve and that new services often lag behind technology advancements. The distinction between 5G networks and services is crucial, and it’s good to see that lessons learned from 5G development are being applied to 6G. The advice for the telecom industry to avoid premature 6G marketing is spot on—real, impactful services take time to develop. Looking forward to seeing how 5G services unfold in the next few years!